In a world filled with uncertainty, insurance stands as a beacon of security. However, what happens when the safety net we’ve woven is frayed, leaving us vulnerable to unforeseen circumstances? Welcome to a space where we explore the often overlooked realm of underinsurance.

Our policies are designed and priced to provide comprehensive coverage for your entire bicycle. It is of utmost importance that you insure your bicycle for its complete value. It is not possible to insure only a portion of the bicycle’s value in an attempt to lower your premium. In the event that you under-insure your bicycle, our claims handlers may apply a “proportional reduction” when settling your claim.

Essentially, attempting to save a small amount on your premium now may ultimately result in much higher costs in the future. This article aims to explain the significance of accurately valuing your bicycle and how any discrepancies can impact your insurance claim.

Can i insure my bike for what i want?

Absolutely not! There exists a common misconception about insurance, wherein individuals believe they can insure their belongings for a value that they would find acceptable in the event of a claim. Let’s take the example of insuring a bike worth £4,000 for only £2,000, with the hope that as long as the claim amount remains below £2,000, it would be covered. This is a clear case of underinsurance, and it often catches customers off guard when they face the consequences of such a claim.

How does underinsurance work?

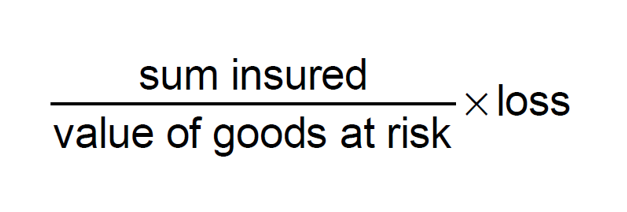

In the scenario where your bicycle holds a value of £4,000, but you choose to undervalue it at £2,000 on your policy, you are essentially underinsured by 50%. Consequently, if you were to file a claim, our policy would only cover 50% of the claim amount, leaving you responsible for paying the remaining portion out of pocket. This principle applies not only to situations where the bicycle is considered a total loss, such as theft or irreparable damage, but also in cases where only a small component of the bicycle, like a brake lever, is damaged while the majority of its value remains intact.

here are some real world examples

Example 1

Bicycle value £3,000. Insured value £1,000, claim value- total loss to £1,000 wheelset.

This client thought that they would only insure the cost of the most expensive component. The claim was for a damaged wheelset which their receipt showed they paid £1000. The client’s excess was £100 and they wanted us to cash settle, as opposed to replace. This meant that in order for us to cash settle for the wheelset, the client was only paid £233.33 (The bicycle was only 1/3 insured so only 1/3 was paid out)

Example 2

Bicycle value £1,000, insured value £800. Claim value-total loss as the bicycle was stolen.

In the above example, the insured wanted to save some money on their policy so only insured 80% of the bicycles value. When the insured submitted their claim, as only 80% of the bicycles value was insured, we could only agree to pay 80% of the claim. Sadly, this meant that for the client to replace their bicycle, they had to pay an additional £200 for their replacement bicycle. The reality was that the £8 saving they made by under insuring the bicycle turned into an additional cost of £200 when they came to claim.

Example 3

Bicycle value £6,000. Insured value £3,000, claim value £1,000.

This person decided to insure their £6,000 bicycle for half of its value. Their reasoning was that if at least half of the bicycles value was covered, then the chances were that bar a total loss, £3,000 would be adequate to cover the cost of replacing any damaged components. As the bicycle was 50% under insured, the claim value was proportionally reduced so the client was paid out £500 less their excess.

Can I avoid underinsurance?

It’s quite simple! To steer clear of underinsurance, it’s essential to insure your cycling equipment for the amount you originally paid for it, rather than its current market value. In case you have made any upgrades or modifications to your equipment, it is crucial to factor in these expenses when determining the insurance coverage.

If you find yourself uncertain about the value of your bike and whether your insurance coverage is adequate, seeking additional assistance from our team is highly recommended. Our support team will happily assist you in evaluating the value of your bike and ensuring that you have comprehensive coverage. When it comes to safeguarding your bike, it’s important not to take any risks. Make sure you have the appropriate level of insurance coverage to fully protect yourself and your valuable cycling equipment!

Top tips on avoiding underinsurance

-Always insure your bike for the price paid

-Include the value of upgraded parts on top of the original purchase price

-If you use a power meter on multiple bicycles, you must ensure that it’s value is included on your most expensive bicycle

-Yellow Jersey do not devalue your bicycle based on its age or condition. Do not insure your bicycle for what you think its currently worth.

-If in doubt, call us on 0333 003 0046